Optimism Vs. Polygon Vs. Arbitrum; Layer 2 Explained

Disclaimer: This is not intended as investment advice in any form.

If you’ve been following our latest blog posts, then you’re likely already familiar with Ethereum’s major dilemma. But just in case you haven’t, we’ll bottom-line the situation with a quick recap:

Ethereum is an excellent blockchain with the power to support everything from transactions to decentralized applications. But due to its decentralization and security measures, the blockchain can only handle so many tasks at a time. As a result, it can occasionally become expensive and slow AF, especially when it’s experiencing a lot of traffic.

Look no further for a prime example than the Cryptokitties incident of 2017. When the NFT game first launched, it proved popular enough to bring Ethereum to a complete standstill. That’s around the time people began to realize Ethereum had a big issue on its hands.

Sure, the fact that adorable digital cats were enough to bring the blockchain to its knees may have been accidentally hilarious. But it was also pretty alarming.

Things got even crazier during the DeFi Summer of 2020 when Ethereum’s boosting popularity again highlighted its most prominent pros and cons. On the one hand, developers were really beginning to grasp Ethereum’s smart contract technology possibilities. Suddenly, new Dapps, NFTs, and DeFi applications flooded the market. On the downside, ETH gas prices rose along with the blockchain’s popularity, spiking to over $200 in August 2020.

Rest assured that Ethereum is well aware of the issue and is working on several upgrades that will hopefully help make things more efficient in the long run. But, unfortunately, such solutions may take years to actually implement.

That’s why a number of layer 2 scaling solutions have been introduced to help solve the problem in the meantime.

What are Layer 2 scaling solutions?

Ethereum Layer 2 scaling solutions are designed to help fix some of Ethereum’s most glaring defects. For example, while many allow Ethereum to handle the decentralization and security aspects of transactions, layer 2 solutions can help keep things from getting congested by handling things like payments.

In a metaphorical sense, they’re sort of like extra checkout lanes at a jam-packed store that was initially only designed to have one or two. Several layer-2 networks have sprung up over the years, but three of the most popular have proven to be Optimism, Arbitrum, and Polygon.

So what are the major differences between the three? Mostly, it goes back to the various technologies each uses to help handle certain Ethereum-based transactions.

Let’s take a closer look at each L2 as we break down their similarities and differences.

What is Optimism?

Optimism is an L2 solution that pioneered “optimistic roll-up,” a concept also used by Arbitrum. The idea is that rather than completing an ETH transaction on the layer 1 Ethereum mainnet, you can hop over to the Optimism line to check out 10x faster.

But what are the benefits of doing so? In simple terms, Ethereum’s transaction process is incredibly thorough, which is why it can sometimes take so long and cost so much. Optimism uses a much more straightforward approach that offers faster transactions and a helluva lot cheaper.

Say, for instance, that a guy named Bob wants to process an Ethereum transaction but doesn’t want to deal with long wait times or obscene transaction fees aka gas fees. Bob could turn to Optimism for an easier solution.

Rather than scrutinize every detail of the transaction before allowing Bob to get on with his life, Optimism assumes that the transaction he proposes is legit. That’s where the whole “optimism” idea comes in.

Over the day, Optimism may complete a hundreds of transactions just like Bob’s. It then “rolls up” these transactions into a compressed form and sends them back to the ETH mainnet.

Convenient, right?

Perhaps you’re not alone if you spot the potential for a big problem. What if it turns out that Bob isn’t quite as upstanding as Optimism assumed? How does Optimism know that Bob isn’t actually the unscrupulous type attempting to take advantage of the system?

Fortunately, this isn’t necessarily as big an issue as initially assumed. While Optimism runs on more of an “innocent til proven guilty” type setup, it also has security measures called fraud proofs in play which can detect suspicious transactions.

If it turns out that Bob has tried to pull a fast one, the person at the other end of the transaction can call him out by disputing the transaction. Should this occur, the transaction will be sent to Ethereum’s layer 1 for scrutinization. If Bob should indeed prove the shady party, the transaction will be canceled, and Bob will be financially penalized.

Governance Token

Optimism has recently announced it’s new governance token. The introduction of a governance token empowers participants within the Optimism network to actively shape its future trajectory. It grants token holders the ability to propose and vote on protocol upgrades, parameter adjustments, and strategic decisions.

As a result, Optimism becomes a more decentralized and community-driven platform. This also provides a sense of ownership and engagement, allowing stakeholders to contribute directly to the project’s evolution and success.

What is Arbitrum?

Arbitrum is another L2 solution similar to Optimism in many ways. For example, both solutions rely on optimistic rollup solutions to work their magic. But there are a couple of crucial differences between the two.

Remember Bob’s questionable transaction? It could be disputed with fraud proofs on Arbitrum, just like on Optimism. But whereas Optimism uses single-round fraud proofs, Arbitrum uses fraud proofs of the multi-round variety.

If Bob had a challenger present themselves on Arbitrum, the two would engage in a series of back-and-forth interactions under the careful eye of an L1 verifier contract. Ultimately, they’d arrive at the exact portion of the transaction that the challenger found questionable.

This makes things a lot easier for the L1 verifier, whose job is to decide which party’s claim is legit. Think of it as two parties arguing over a contract. However, rather than forcing the L1 verifier to pour over the entire document, the two parties would be forced to highlight the exact part in question before presenting their cases.

While this is one of the main differences between Optimism and Arbitrum, a few others are worth mentioning. The first is that while Optimism has its own native token, Arbitrum currently does not. Arbitrum also has features that can add advanced privacy features to ETH smart contracts.

Lastly, Arbitrum has a virtual sandbox setup called the Artbitrum Virtual Machine or AVM. Optimism piggybacks off of the Ethereum Virtual Machine or EVM. So, in plain English, Optimism relies more on the Ethereum network than Arbitrum.

What About Polygon?

Okay, so Optimism and Arbitrum are admittedly pretty similar. But whereas Polygon can utilize optimistic rollup solutions, it’s no one trick pony. Polygon, formerly known as Matic Network, is not only an L2 solution, but it’s also what’s known as a sidechain. This means that Polygon is an entirely different blockchain connecting to the Ethereum blockchain via a series of bridges.

The cool thing about Polygon is that its blockchain supports multiple L2 solutions. These include the optimistic rollups that Optimism and Arbitrum rely on and plasma chains and ZK rollups.

Plasma Chains

Plasma chains are also called “child chains” because they are essentially smaller copies of the blockchain they are designed to function on. In other words, a Polygon plasma chain is like a baby Ethereum. It’s designed to help Ethereum complete a portion of its transactions off-chain.

Plasma chains also function as bridges that allow users to transfer their digital assets back and forth to Ethereum, so they still benefit from some of its security.

ZK rollups

Zero Knowledge rollups, or ZK rollups, are a cool but incredibly complex scaling concept. The idea behind them is that they run on codes designed to prove that statements are valid before sending them back to the Ethereum mainnet.

Polygon recently launched a next-level ZK rollup called zkEVM, which is congruent with the Ethereum Virtual Machine. zkEVMs are a big deal because they allow users to access all the same smart contract features they’d enjoy on the Ethereum mainnet.

In essence, Polygon isn’t just a great solution; it’s the home of a whole collection of them. It also has its own native token called MATIC, which users can use for staking and payments.

Consensus Mechanism

Polygon benefits from using the PoS consensus mechanism because it allows for quicker blockchain transactions and lower fees compared to Ethereum’s traditional method. This means you can send money or use apps on Polygon’s network without waiting as long or paying high fees. It’s like using a faster and cheaper highway instead of a slower and more expensive road.

In addition to being faster and cheaper, PoS also offers security advantages for users’ crypto assets. It makes it harder for bad actors to attack the network and cheat the system, which helps protect your daily transactions and information.

So, Polygon is often preferred for its PoS consensus mechanism, which helps you with cheaper and faster transactions.

The Need for Speed

When it comes to the race for the best Ethereum layer 2 scaling solution, Polygon also gets bonus points for speediness and better user experience.

Polygon takes the cake in this category for two different reasons. First, it can handle more daily transactions per second than its colleagues. One of Ethereum’s main issues has always been that it can only manage a relatively paltry number of transactions simultaneously.

While Optimism can help with 2,000 transactions per second and Abritrum can handle 40,000, Polygon can process an impressive 65,000 without breaking a sweat. Then there’s the issue of withdrawal wait time.

There’s no doubt that all three of our contenders do a killer job in lowering gas fees and helping decongest the ETH mainnet. But the trade-off is that you must wait a bit before withdrawing your tokens after completing a transaction on any of them.

Polygon comes with a three-hour waiting period. While a bit inconvenient, it’s not so bad when you consider that you may have to wait anywhere from one to two weeks before making a withdrawal from Optimism or Arbitrum. A big part of this wait time goes back to the idea of optimistic rollups and allowing any challengers the chance to dispute transactions.

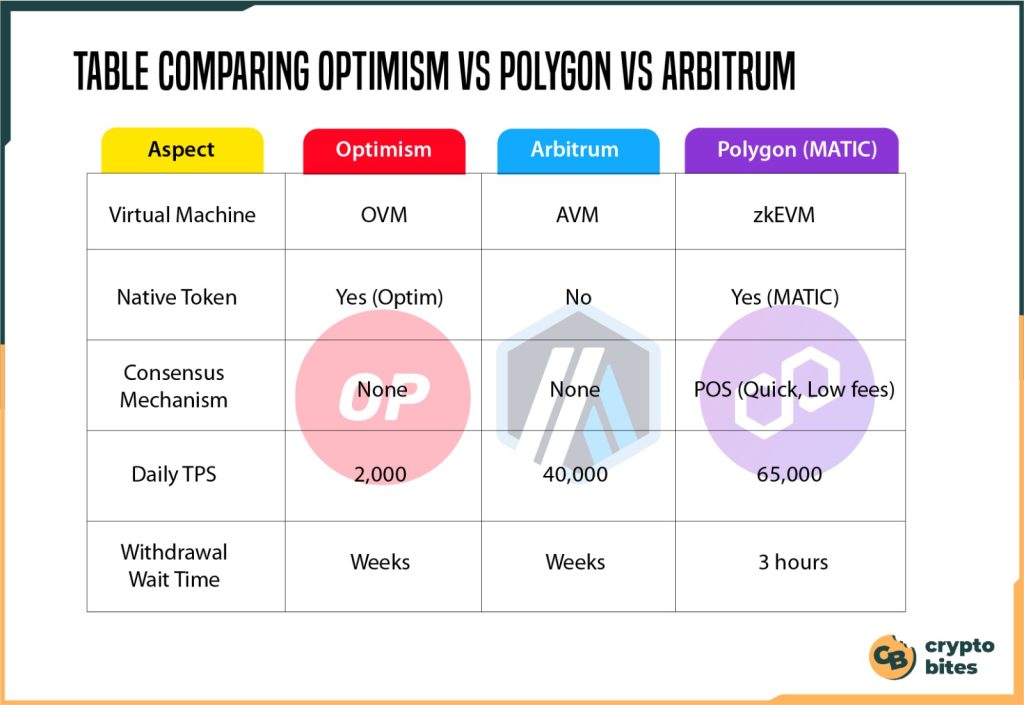

Here is a table that compares the 3 L-2 solutions based on different features and benefits:

Table Comparing Optimism Vs Polygon Vs Arbitrum

So which layer 2 solution is best? This may vary from developer to developer. But, as you can see, Polygon’s got plenty of great arguments in its favor.