Blockchain Economics – A Definitive Guide for 2024

The demand for instant peer-to-peer interactions is reshaping various aspects of our lives, from work to consumption and investment.

Companies like Amazon and Facebook have been at the forefront of this shift. However, trust remains a significant challenge in open systems. This is where blockchain technology steps in, offering decentralized solutions to address trust issues.

Today, I will explore the economic implications of blockchain, focusing on its advantages, design principles, and key issues.

Join me as I hunt through the evolving landscape of blockchain economics and its impact on our digital future!

Benefits of Decentralization in Blockchain Economics

Decentralization offers a plethora of benefits in economics that extend far beyond mere transparency or anonymity.

While centralized systems like governments and large IT firms have historically provided trusted platforms, decentralization introduces a paradigm shift with three core advantages:

1. Stronger Security

Decentralization reduces the risk of system-wide failure and malicious attacks by distributing data and decision-making across a network of nodes.

This increased security reduces the potential economic losses associated with downtime, data breaches, and cyberattacks, thereby safeguarding the stability and viability of businesses and financial transactions.

2. Empowerment

Decentralization democratizes access to resources and decision-making, fostering inclusivity and enabling greater participation in governance and economic activities.

Removing barriers to entry and empowering individuals and communities to participate in economic activities, decentralization stimulates innovation, entrepreneurship, and economic growth, leading to a more dynamic and resilient economy.

3. Transparency and Trust

Decentralized systems ensure transparency and accountability through public ledgers and cryptographic techniques, promoting trust among users and eliminating the need for a central authority.

Trust facilitates economic transactions and interactions, reducing transaction costs, mitigating counterparty risks, and fostering greater confidence in financial markets and digital platforms, thereby contributing to overall economic stability.

Protecting Against Single Point of Failure

Decentralization in blockchain acts as a strong defense against the risks posed by single points of failure (SPOFs) in systems. In traditional centralized setups, the failure of a critical component—like a server or database—can cause widespread disruptions.

But decentralized blockchains distribute records across many nodes. So, even if some nodes fail, the network keeps running, ensuring reliability.

This resilience isn’t just about technical issues. It also addresses economic risks in centralized systems. For example, the Cambridge Analytica scandal exposed how Facebook’s centralized control over user data led to misuse. By spreading decision-making and data management, blockchain tech reduces these risks.

Moreover, blockchain records are tamper-proof, ensuring a reliable history. This helps with decision-making and planning, boosting economic resilience.

In short, decentralization strengthens both technical and economic aspects of systems. Spreading authority and improving transparency, it builds trust, encourages innovation, and supports sustainable growth.

Blockchain vs Banks

Blockchain technology has been hailed as a game-changer in the financial industry, particularly in relation to payments and banking. Decentralized blockchains, on the other hand, differ greatly from banks.

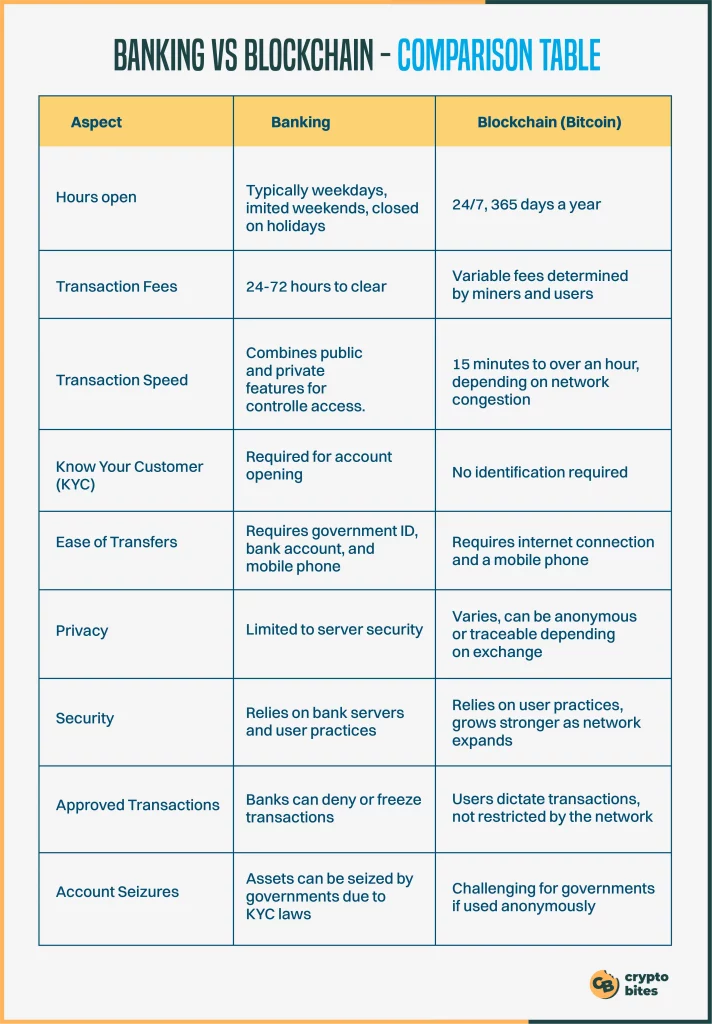

Let’s examine the differences between a bank and blockchain by contrasting the banking system with the blockchain implementation of Bitcoin.

Banking vs Blockchain – Comparison Table

This table provides a concise comparison between traditional banking and blockchain technology, specifically focusing on Bitcoin as an example of blockchain implementation.

Blockchain in Banking and Finance

The banking sector stands to benefit significantly from the integration of blockchain technology into its operations. Unlike traditional financial institutions, which operate within limited hours, blockchain operates 24/7, offering unparalleled accessibility and efficiency.

Consider the scenario of depositing a check on a Friday evening. In traditional banking systems, funds may not appear in the account until the following Monday morning due to weekend closures.

Moreover, even during regular business hours, transactions can take one to three days to verify due to the high volume of transactions processed by banks.

However, with blockchain, transactions can be completed in a matter of minutes or seconds, irrespective of the day, week, or holiday.

Banks can transfer funds swiftly and securely between organizations, reducing costs and risks associated with prolonged transaction times, thanks to application of blockchain.

Blockchain has the potential to revolutionize stock trading. Currently, traders may have to wait up to three days for the settlement and clearing process, during which funds and shares are locked. However, blockchain could significantly shorten this period, enhancing liquidity and efficiency in the stock market.

Blockchain in Currency

Blockchain, the backbone of cryptocurrencies like Bitcoin, presents an alternative to traditional currency systems governed by central authorities such as the Federal Reserve. Unlike centralized currencies, which rely on banks or governments for security, blockchain decentralizes currency management, reducing vulnerabilities associated with central control.

Centralized currency systems face risks like bank failures or government instability. The financial crisis of 2008 prompted the creation of Bitcoin as a decentralized alternative. Blockchain technology offers a more stable financial system and currency, especially beneficial for individuals in nations with uncertain financial infrastructures.

By distributing currency activities across a network of computers, blockchain removes the need for a central authority, cutting transaction costs and risks.

This decentralized approach enhances financial stability and expands access to financial services, particularly for those without state identification.

In regions affected by conflict or lacking functional identification systems, blockchain-based solutions like bitcoin wallets provide access to savings accounts and secure transactions.

Blockchain enables individuals to engage in commerce domestically and internationally, connecting with a broader network while mitigating risks associated with centralized currency systems.

Blockchain in Property Records

The current process of recording property rights is cumbersome and inefficient, often requiring physical documents to be presented to government offices for manual input into databases. This process is not only time-consuming and expensive but also prone to human error, which can lead to inaccuracies in property ownership records.

Blockchain technology has the potential to revolutionize property records management by eliminating the need for physical documents and manual data entry. Instead, property ownership can be securely recorded and verified on a blockchain ledger.

This decentralized and transparent system ensures that property ownership timelines are documented in a clear and unambiguous manner.

In regions with limited government infrastructure or in conflict zones, blockchain offers a reliable solution for proving property ownership. Residents can securely record and verify property transactions without relying on traditional government or banking systems.

This not only enhances the efficiency of property management but also ensures the integrity and security of property ownership records, even in challenging environments.

Blockchain in Supply Chains

Blockchain technology holds significant potential in revolutionizing supply chains by enhancing transparency and traceability throughout the entire supply process.

Suppliers can use blockchain to document the origin and journey of products they acquire, similar to the IBM Food Trust example. This allows businesses to verify the authenticity of their products and validate claims associated with labels such as “Local,” “Organic,” and “Fair Trade.”

The food sector, in particular, is increasingly adopting blockchain technology to track the safety and route of food products as they move from farms to consumers.

By recording each step of the supply chain on a blockchain ledger, stakeholders can ensure food safety, prevent fraud, and respond promptly to any issues that arise.

This transparency not only enhances consumer trust but also facilitates regulatory compliance and improves overall efficiency in the supply chain.

Some Downsides of Blockchain

Let’s look at some of the potential issues with blockchain:

1. High Cost

While blockchain technology offers potential cost savings on transaction fees, it is not without its drawbacks, particularly in terms of expenses.

For example, the proof-of-work mechanism utilized by the Bitcoin network for transaction approval consumes a considerable amount of processing power. In fact, the energy consumption of the Bitcoin network surpasses that of entire countries like Pakistan on an annual basis.

Addressing these energy consumption issues is crucial. Some solutions are emerging to mitigate these problems.

For instance, bitcoin mining farms are increasingly powered by renewable energy sources such as wind farms, solar electricity, or surplus natural gas from fracking sites.

While these efforts help alleviate environmental concerns, they also add to the overall cost of blockchain technology implementation.

2. Inefficiency in Speed and Data

An example highlighting the potential inefficiencies of blockchain technology is Bitcoin. Bitcoin’s Proof-of-Work algorithm adds a new block to the blockchain roughly every ten minutes, with the network capable of handling only three transactions per second (TPS) at that rate. This limitation applies to other cryptocurrencies like Ethereum, despite their better performance compared to Bitcoin. For comparison, the legacy Visa brand can process 65,000 TPS.

Efforts to tackle this issue have long been ongoing, resulting in the development of blockchains with throughputs exceeding 30,000 TPS.

The upcoming integration of Ethereum’s main net and beacon chain, expected on September 15, 2022, aims to support up to 100,000 TPS following updates such as sharding.

Sharding involves dividing the database to improve Ethereum’s compatibility with various devices, like laptops, tablets, and phones. This is expected to enhance transaction speeds, reduce congestion, and boost network participation.

Another significant concern is the limitation on the amount of data each block can store. The scalability of blockchains has been and will continue to be influenced by the block size controversy.

3. Illegal Activities

While privacy measures on the blockchain network protect users’ privacy and shield them from hackers, they also enable illicit behavior and trade.

The Silk Road, an online dark web marketplace for illegal drugs and money laundering, operated from February 2011 until October 2013 before being shut down by the FBI. It is perhaps the most frequently cited example of blockchain being exploited for criminal activities.

Using the Tor Browser allows individuals to conduct transactions for illicit goods on the dark web without detection. This includes buying and selling items using Bitcoin or other cryptocurrencies for unlawful purposes.

However, in the United States, financial service providers are required to comply with regulations that mandate the collection of consumer information during account opening.

This involves verifying the identity of each customer and ensuring they are not affiliated with any known or suspected terrorist groups.

There are both advantages and disadvantages to this approach. On one hand, making financial accounts accessible to everyone can promote financial inclusion, but it also makes transactions easier for thieves.

Despite this, many argue that the benefits of cryptocurrencies, such as providing banking services to the unbanked population, outweigh their drawbacks.

It’s worth noting that while cryptocurrencies may be associated with illicit activities, the majority of such activities still rely on untraceable cash.

Bottom Line

Blockchain technology has emerged as a transformative force in economics, offering unparalleled opportunities for efficiency, transparency, and inclusion.

While challenges such as scalability, speed, and regulatory concerns remain, the potential benefits of blockchain in revolutionizing financial systems, supply chains, property records, and more cannot be overstated.

As we navigate the evolving landscape of blockchain economics, it is essential to harness its power responsibly, leveraging its strengths to drive positive change while mitigating risks.

With continued innovation and collaboration, blockchain holds the promise of reshaping economies and empowering individuals worldwide.