What is a Cryptocurrency Exchange? – A Complete Guide

Cryptocurrencies have become a popular topic in the finance world lately.

They made a big impact on finance and technology.

Acting as an alternative to traditional currency, crypto enthusiasts initially focused on bitcoin mining for profits.

Later, there was a shift towards starting crypto exchanges.

Cryptocurrencies now form a $1.50 trillion asset class, causing global disruption with distributed ledger technologies.

Currently, there are over 500 crypto exchanges, each with unique features and interfaces.

Some are regulated, while others are completely decentralized, meaning they can’t be regulated.

The cryptocurrency market is valued at over one trillion, fueled by a craze for digital currencies and decentralized finance.

New virtual currencies pop up regularly, prompting curious crypto investors to seek platforms for swift digital asset trading.

Similar to traditional stock exchanges, cryptocurrency exchanges are platforms enabling participants to trade different cryptocurrencies.

Interest has risen due to issues with major exchanges like FTX and the ongoing Binance-SEC situation.

Certain exchanges allow buying crypto with fiat (e.g., Euro or U.S. Dollar), while others require trading digital assets in pairs.

To meet demand, numerous exchanges have emerged in the last five to ten years.

Functioning like e-brokerages, they provide various financial tools, allowing participants to trade cryptocurrencies, use margin trading, and speculate on prices through futures contracts.

In this article, we’ll explore cryptocurrency exchanges, how they operate, different types, and some of the leading exchanges today.

What is a Cryptocurrency Exchange?

A cryptocurrency exchange is like an online marketplace where people trade cryptocurrencies or digital assets at set prices.

Think of it as a digital hub where you can buy, sell, or trade cryptocurrencies such as Bitcoin, Ethereum, or Litecoin.

It’s handy because it brings buyers and sellers together without them having to find each other.

These exchanges work similarly to stock markets, helping you buy and sell digital currencies using apps or desktop platforms, just like online brokerages.

They offer various tools for trading and investing.

You can do lots of things on these exchanges, like margin trading, futures, options, and more.

But using these services often means paying fees based on what you’re doing.

Before these exchanges, getting crypto was a bit trickier, involving mining or arranging deals in online forums.

Nowadays, there are loads of crypto exchanges worldwide, each with its own currencies and fees.

Unlike regular markets, where fees have dropped, crypto trading can still cost more.

Lots of folks use these exchanges to switch between fiat money (like dollars) and cryptocurrencies or between different cryptocurrencies.

Most exchanges are companies that match buyers and sellers and charge fees for their services.

Some even work like banks, taking deposits, lending money out, and making a profit from the interest.

Using these exchanges does come with risks, as shown by recent issues with various platforms.

One big plus is that you can switch between cryptos and even trade on borrowed money for potentially bigger gains (or losses).

These exchanges usually fall into two main types: centralized (CEXs) and decentralized (DEXs).

Centralized ones, like Coinbase or Binance, are easier to use but controlled by a single authority.

On the flip side, decentralized exchanges like Uniswap give users more control and privacy.

Many people worry about trusting centralized exchanges with their coins, as the saying goes, “Not your keys, not your coins,” highlighting how owning your private keys is crucial for security.

Centralized exchanges sometimes hold onto your keys, which can be risky if they get hacked or have problems.

How Does a Cryptocurrency Exchange Function?

Setting up an account on a crypto exchange lets you buy and sell different cryptocurrencies like bitcoin, ether, Litecoin, Polkadot, Dogecoin, and more.

These exchanges differ; some let you buy crypto with regular money like U.S. dollars, while others allow you to trade one crypto for another.

The big ones usually offer a bunch of different cryptocurrencies, but it’s smart to check if they have the one you want before signing up.

On these exchanges, you can use your regular money to buy crypto or trade one type of crypto for another.

You can keep your crypto in the account for future trades, turn it back into regular cash, or take it out as cash.

But remember, what you can do might vary between exchanges or apps.

Some won’t let you move your crypto to your own wallet.

Unlike traditional exchanges with fixed hours, crypto exchanges are open 24/7.

These exchanges can usually send your crypto to your personal wallet or even convert your digital currency into anonymous prepaid cards, which you can use at ATMs worldwide.

The people who create digital currencies are usually separate from the exchanges that let you trade them.

In one type of system, businesses called digital currency providers (DCP) manage accounts for customers but don’t directly give them digital currency.

Customers buy or sell digital currency through exchanges, which move the digital currency into or out of the customer’s DCP account.

Digital currency exchanges can be actual shops or strictly online businesses.

As physical stores, they swap regular money for digital currencies. Online, they deal with electronically transferred money and digital currencies.

A lot of these exchanges operate outside Western countries to avoid rules and legal issues.

They handle Western money and keep bank accounts in different places for deposits in various currencies.

Then there are decentralized exchanges like Etherdelta and IDEX.

They don’t hold onto users’ funds but help people trade cryptocurrencies directly.

These decentralized ones are less likely to have security problems, but they sometimes have lower trading volumes.

How to Trade on a Cryptocurrency Exchange?

To start trading, you put money in your exchange account, often called a wallet.

Remember, the wallet from the platform or app is usually on that platform.

It’s smart to set up your own crypto wallet for extra security (we’ll talk more about that later).

Once you’re set up, you can check out the prices of different cryptos, but keep in mind that the exchange doesn’t set these prices—they’re set by the market and updated in real-time.

Because cryptocurrencies aren’t controlled by one authority, prices might differ a bit between exchanges.

When you want to buy, say, bitcoin or ether, you place an order, which gets added to a list of all buy and sell orders.

Fees on these platforms can vary depending on where you’re trading—some might charge higher fees compared to traditional markets.

Unlike regular markets, where fees have gone down, crypto trading often costs more.

Fees can be high, sometimes even 5% or more per trade, but many are lower, around 0.5% or less per trade.

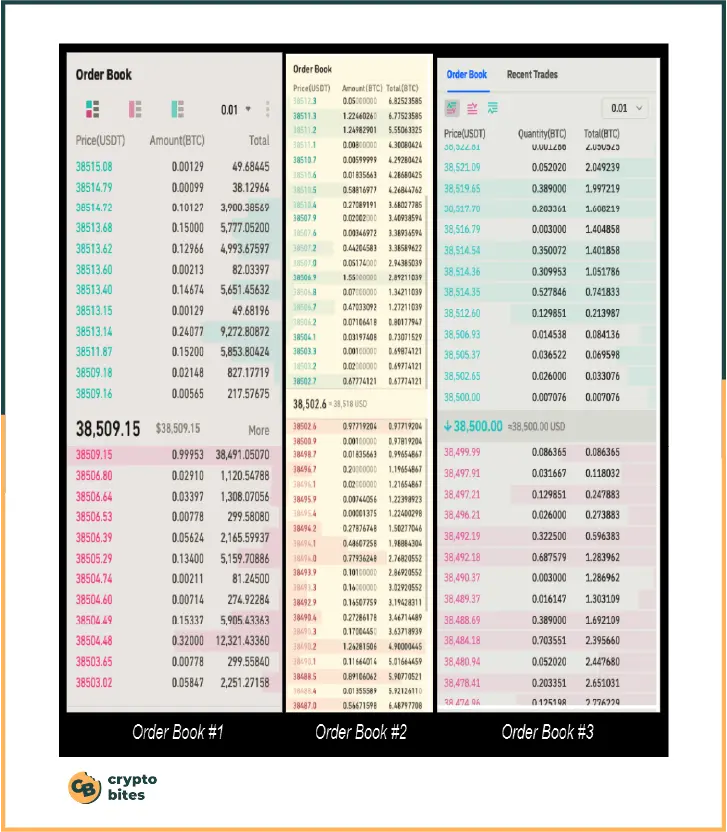

When you trade on a crypto exchange, it mostly happens through a live order book.

This book shows live buy and sell orders, which directly affects the exchange rate of the cryptocurrency.

Since each exchange calculates prices based on its trading volume, one with more users is likely to have more accurate prices.

That’s why you might notice slight differences in cryptocurrency prices across exchanges.

There are different types of orders you can place, but the most common ones are “Limit Order” and “Market Order.”

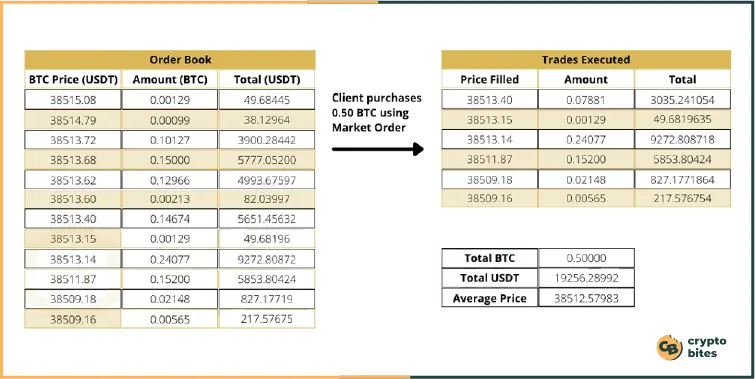

Let’s take an example using Order Book #1. Say you want to buy 0.50 BTC on the BTC/USDT pair.

With a Limit Order, you specify a price (e.g., $38,500) and wait for a buyer or seller to match it

A limit order at $38,500.00 means you want to trade your funds at that price or better. But it doesn’t guarantee your order will happen unless there’s a buyer or seller willing to trade at that price.

A Market Order, on the other hand, trades your funds at the best available market price in the order book.

For instance, if you wanted to buy 0.50 BTC, a market order would aggregate the best prices, and you might end up with an average price of $38,512.58 per BTC. This is assuming that the order book stays the same.

As you can see, making large trades can be tricky on exchanges because prices might change and you might not get the best deal.

How Do Cryptocurrency Exchanges Make Money?

Cryptocurrency exchanges make money mainly through commissions and fees.

Some platforms might offer free or discounted services to attract users and sell their tokens, but this approach often doesn’t work well.

It’s more reliable to run an honest and transparent business, with providing great service as the key to earning revenue.

Crypto exchanges use various ways to make money:

1. Charging a Fixed Fee for Escrow Services

Decentralized, or P2P, platforms often use this method. Users negotiate deals independently and finalize transactions outside the platform.

To ensure a smooth deal, exchanges offer escrow accounts to protect both buyers and sellers.

2. Taking Fees from Deals

Centralized exchanges charge small fees, usually between 0.01% and 2%, for transactions.

These fees apply to sellers, buyers, or both.

For the exchanges to make money, users must continue trading. This is a system that many individual traders find appealing.

3. Providing Leverage

For certain digital assets and derivatives, if you need financial support to open positions, the exchange offers it for a fee.

Margin accounts, allowing traders to make money through trading, are popular.

Exchanges might also offer additional services, products, or investment plans to make money, but the bulk of their income typically comes from commissions earned as middlemen in transactions.

Things to Check Before Selecting a Crypto Exchange

Using a cryptocurrency exchange to store or trade your regular money (fiat) and digital assets can be risky.

In some cases, people found out their assets were gone or locked up due to bankruptcy.

When you put your digital assets on an exchange without having your own wallet, you’re giving the exchange complete control.

Because exchanges hold a lot of currency, hackers often target them.

Mt. Gox, the world’s biggest exchange in 2014, got hacked, resulting in the theft of hundreds of millions.

Recently, Crypto.com admitted to a $35 million hack in January 2022.

Although cryptocurrency exchanges may act like brokers or bankers, they’re not typically registered or regulated by state or federal authorities.

This lack of regulation means consumers don’t have much information about the safety of exchanges, and their assets aren’t protected by regulatory authorities.

Be careful when picking a crypto exchange to avoid trouble.

While a crypto exchange might seem simple, it can be complex and needs more scrutiny than traditional stock exchanges since it’s mostly unregulated.

Here are some key points to save you from potential fraud or risk:

- Check if a firm is registered as a securities broker.

- Choose an exchange incorporated or registered in your country for better investigation if needed.

- The exchange should tell you what it does with your funds. If they manipulate or mix your funds, recovering them in bankruptcy might be tough.

For example, FTX faced risks due to bad lending practices.

- Look for the exchange on social media sites like LinkedIn, Twitter, or Facebook.

- Check the customer support of the exchange. Try contacting them via toll-free numbers or chat before making a decision.

- Find out the exchange’s wallet. Legitimate ones disclose their cryptocurrency reserves. If they hide this information, it could be a sign of an unreliable exchange.

What Are the Different Crypto Exchanges?

Cryptocurrency exchanges come in various types, and often, they have features that overlap.

For instance, a centralized exchange might also have peer-to-peer (P2P) trading and an over-the-counter (OTC) desk.

These variations offer different options for investors looking to trade cryptocurrencies.

Here are some of the most common types of cryptocurrency exchanges.

Centralized Exchanges (CEX)

Centralized cryptocurrency exchanges, often called CEXs, are the most common type in the crypto market and work like traditional stock exchanges.

A centralized exchange is a platform owned and run by a single entity, acting as a go-between for buyers and sellers.

This intermediary, or third party, assists in transactions by providing liquidity for supported tokens.

The platform uses an order book system to set crypto prices, similar to how a traditional bank operates.

Users typically deposit funds into an account held by the exchange, which acts as a custodian for those funds.

Users trust the platform to handle their funds safely and fairly.

The exchange matches buyers with sellers, facilitating trades on their behalf.

Centralized exchanges can be divided into five categories: Order Book Exchange, Ads-based Exchange, User to Admin Exchange, Crypto Derivatives Exchange, and Margin Trading Exchange.

Key features of centralized crypto exchanges include an easy-to-use interface and various trading tools, making crypto usage less challenging.

CEXs offer different services, including fiat-to-crypto pairings, allowing users to directly buy cryptocurrencies with traditional fiat currencies like USD, EUR, or GBP.

This feature simplifies the process for beginners entering the crypto market, bridging the gap between digital and traditional financial systems.

Crypto-to-crypto pairings are another common offering, enabling traders to exchange one cryptocurrency for another without converting to fiat currency first.

Each pairing has its own market dynamics, reflecting supply and demand within the platform.

Major players like Binance, Coinbase, and Kraken provide a variety of these pairings due to their high trading volumes.

Decentralized Exchanges (DEX)

A Decentralized Exchange (DEX) is quite different from traditional centralized exchanges because it doesn’t involve a middleman.

Instead of using intermediaries, DEX transactions are managed by built-in lines of code called Smart Contracts.

Unlike centralized exchanges (CEX), DEX doesn’t hold users’ funds and doesn’t require registration.

It enables direct peer-to-peer transactions from your digital wallet without needing an intermediary.

Examples of DEXs include Uniswap, PancakeSwap, dYdX, and Kyber.

These decentralized exchanges rely on smart contracts, pieces of code that self-execute on a blockchain.

Smart contracts offer more privacy and lower transaction costs than centralized exchanges.

However, because there’s no middleman to oversee transactions, DEXs are more suited for experienced investors.

DEX is similar to P2P Ads-based exchanges but with a few differences.

In a DEX, transactions aren’t monitored, and they’re entirely automated and controlled by users.

Users on DEX platforms don’t need to share their identity details; they only connect their wallets to access the platform directly.

DEX forms the foundation for Defi, NFT Marketplaces, and Metaverse, with decentralization being their shared characteristic.

Top Crypto Exchanges

Here are some of the top crypto exchanges that are operating right now:

1. Coinbase

Coinbase is perfect for beginners with its simple interface and support for various cryptocurrencies. However, be aware of higher fees and fewer advanced features.

2. Binance

As the world’s largest crypto exchange, Binance offers diverse features like margin trading. Yet, it’s not available everywhere, and customer support is a concern.

3. Kraken

Kraken suits experienced traders with advanced features and a focus on security. However, its interface may not be as user-friendly, and fees can be on the higher side.

4. Gemini

Gemini is great for newcomers with low fees and high security. But, it has a limited choice of cryptocurrencies.

5. Crypto.com

Crypto.com goes beyond trading, offering staking, lending, and a crypto debit card. Watch out for potential higher fees and customer support concerns.

Choosing Your Exchange: Key Factors

- Fees: Check the fee structures for different trades and payment methods.

- Security: Opt for exchanges with strong security measures.

- Customer Support: Ensure responsive customer support.

- Features: Consider available features like margin trading and staking based on your preferences.

Remember, the best exchange depends on your needs, whether you’re a beginner or an experienced trader. Understanding each platform’s strengths and weaknesses is vital in the crypto world.

How to Create an Account on a Cryptocurrency Exchange?

All exchanges generally follow a similar set of steps for users:

- Start by visiting the exchange website.

- Click on “Sign Up” or “Create Account.”

- Provide your email and create a strong password.

- You might need to share personal information, IDs, and a picture holding your ID for KYC (Know Your Customer) verification.

- Agree to the exchange’s terms and conditions.

- Confirm your email by clicking on a link sent to your inbox.

- Once verified, you can access your newly created account.

- Ensure the exchange has two-factor authentication (2FA) for added security.

- Some crypto exchanges also offer paper trading options, allowing users to practice before actually trading.

- To start trading, you’ll need to deposit funds into your account.

Cryptocurrency exchanges enforce identity verification and robust security measures to safeguard users and the platform.

Verification procedures help prevent illegal activities like money laundering by complying with KYC/AML regulations.

By employing strong passwords and 2FA, these measures protect users’ assets from theft and hacking attempts.

Exchanges that lack these security measures risk losing funds and damaging their reputation.

Final Takeaway

The future of cryptocurrency exchanges looks promising with the increasing popularity of digital assets.

These platforms play a crucial role in enabling cryptocurrency trading and investment, catering to the rising demand from both institutional and retail investors.

At first glance, a crypto exchange seems straightforward – a place to buy and sell various types of cryptocurrencies.

However, in the world of crypto, things can get a bit intricate, requiring more attention from users compared to traditional financial exchanges.

It’s important to note that the crypto industry, including coins, platforms, blockchains, exchanges, and wallets, operates with limited regulations.

Unlike the conventional financial world, where there’s a standard structure, the crypto landscape is less regulated.

Therefore, taking extra time to grasp the basics, such as whether an exchange operates in your region and understanding fees, becomes crucial.

Delving into more complex topics, like selecting the right wallet, is also essential for navigating the crypto space effectively.