What is Cryptocurrency? A Definitive Guide!

Disclaimer: This is not intended as investment advice in any form.

Cryptocurrency is a type of digital currency that works on a decentralized network. It operates without a central authority, using blockchain technology to securely record transactions.

Unlike regular money, it’s not controlled by a government or central bank. Cryptocurrencies like Bitcoin are stored in digital wallets, allowing people worldwide to send and receive money independently.

This new form of money offers a borderless and decentralized alternative to traditional currencies.

They allow for fast and cheap transactions, and can be used for a variety of purposes, from online shopping to international money transfers.

Bitcoin and Ethereum are two of the most popular cryptocurrencies, but there are many others available.

Key Takeaways

- Cryptocurrency is a digital or virtual currency that is secured by cryptography.

- It operates independently of a central bank and uses blockchain technology to maintain a public ledger of all transactions.

- Cryptocurrencies are gaining popularity due to their secure and transparent nature, and can be used for a variety of purposes.

Delving into the Crypto Basics

Cryptocurrency, also known as crypto, is a digital or virtual currency that uses cryptography to secure transactions and to control the creation of new units.

Unlike traditional currencies, cryptocurrencies are not issued or regulated by any central authority such as a government or financial institution.

Instead, they are managed by decentralized networks of computers running open-source software.

At its core, cryptocurrency is based on the principles of cryptography, which is the practice of securing communication from third-party interference.

Cryptography is used to secure transactions and to control the creation of new units. This makes it difficult for anyone to counterfeit or double-spend the currency.

Compared to traditional currencies, cryptocurrencies offer several benefits. For one, they are generally more secure and private.

Transactions are recorded on a public ledger, but the identity of the parties involved is kept anonymous.

Additionally, cryptocurrencies are not subject to the same regulations and fees as traditional currencies, making them a more cost-effective option.

When compared to fiat currencies, cryptocurrencies offer several advantages. For one, they are not subject to the same inflationary pressures as fiat currencies, which can be subject to government manipulation.

Additionally, cryptocurrencies offer greater privacy and security, as transactions are recorded on a public ledger, but the identity of the parties involved is kept anonymous.

Overall, cryptocurrency is a complex and rapidly-evolving field. However, with a basic understanding of its core concepts and benefits, you can begin to explore this exciting new world of digital currency.

Dispelling Myths – Common Misconceptions About Cryptocurrencies

As the world of cryptocurrency continues to evolve, it’s surrounded by a myriad of myths and misconceptions. It’s essential to debunk these misconceptions to gain a clearer and more accurate understanding of cryptocurrencies. Let’s explore some of the most common myths:

Myth 1: Cryptocurrencies Are Mainly Used for Illegal Activities

Reality: While it’s true that cryptocurrencies have been used for illegal transactions, the same can be said for any currency. In reality, the transparency and traceability of blockchain technology can actually aid in tracking illicit activities. The vast majority of cryptocurrency transactions are for legitimate purposes.

Myth 2: Cryptocurrencies Have No Real Value

Reality: The value of cryptocurrencies, like any currency, is determined by supply and demand dynamics in the market. Unlike fiat currencies, some cryptocurrencies have a capped supply, which can drive demand. Additionally, the underlying technology, utility, and community trust also contribute to their value.

Myth 3: Cryptocurrencies Are Not Secure

Reality: Cryptocurrencies leverage advanced cryptographic techniques, making them extremely secure. The primary security risks stem from user error (like losing private keys) or security lapses in exchanges and wallets, not the cryptocurrency itself.

Myth 4: Cryptocurrency Transactions Are Completely Anonymous

Reality: Most cryptocurrencies, including Bitcoin, are not entirely anonymous but rather pseudonymous. While identities are not directly tied to transaction records, all transactions are public and traceable on the blockchain.

Myth 5: Cryptocurrencies Are a Passing Fad

Reality: Given the increasing institutional investment and growing acceptance as a payment method, cryptocurrencies show signs of long-term staying power. While the market is indeed volatile, the concept of digital currency is becoming more entrenched in financial systems worldwide.

Myth 6: Cryptocurrency Investing Is Easy Money

Reality: Like any investment, cryptocurrency investing carries risks, and the market is known for its high volatility. Educated and strategic investing is crucial, and it’s not a guaranteed way to make quick profits.

Myth 7: Energy Consumption Makes Cryptocurrencies Environmentally Unfriendly

Reality: While certain cryptocurrencies like Bitcoin have significant energy demands due to their mining processes, the industry is moving towards more sustainable practices. Additionally, newer cryptocurrencies use energy-efficient consensus mechanisms like Proof of Stake (PoS).

The Inception and Evolution of Cryptocurrencies

Bitcoin, the first and most well-known cryptocurrency, was developed in 2009 by an unknown person or persons under the alias ‘Satoshi Nakamoto. The invention of Bitcoin marked the beginning of a new era in the world of finance and technology.

The Birth of Bitcoin and the Mystique of Satoshi Nakamoto

Bitcoin was invented as a decentralized alternative to traditional currency systems. It uses a distributed ledger called the blockchain to record transactions and prevent double-spending. The blockchain is maintained by a network of computers around the world, which work together to validate and confirm transactions.

The identity of Satoshi Nakamoto is a bigger mystery than where all our socks disappear to in the dryer. Some people believe that it is a pseudonym for a group of developers, while others think that it is the name of a single person. Whoever Satoshi Nakamoto is, they are credited with creating one of the most innovative and influential technologies of the 21st century.

The Rise of Altcoins and Diverse Cryptocurrencies

Bitcoin paved the way for the creation of other cryptocurrencies, known as altcoins. One of the most significant of these is Ethereum, which was introduced in 2015. Ethereum is more than just a cryptocurrency; it is a platform for building decentralized applications (dApps) that can run on the blockchain.

Other notable cryptocurrencies include Ripple, Litecoin, and Bitcoin Cash. Each of these has its own unique features and use cases. For example, Ripple is designed for fast and cheap cross-border payments, while Litecoin is a faster and more efficient version of Bitcoin.

The evolution of cryptocurrencies has been rapid and exciting, with new projects and innovations emerging all the time. As the technology continues to mature, it is likely that we will see even more diverse and sophisticated applications of blockchain and cryptocurrency.

The Concept of Blockchain Technology

Blockchain technology is the backbone of cryptocurrencies like Bitcoin, Ethereum, and many others. It is a distributed ledger technology that records transactions in a secure and transparent way. The blockchain is a chain of blocks, where each block contains a record of multiple transactions.

The blockchain is a public ledger, which means that anyone can view the transactions recorded on it. However, the information recorded on the blockchain is encrypted and cannot be modified, making it secure and tamper-proof.

The blockchain is maintained by a network of nodes, which are computers that validate transactions and add them to the blockchain. Each node has a copy of the blockchain, and any changes made to the blockchain must be approved by a majority of the nodes in the network. This makes the blockchain decentralized, meaning that there is no central authority controlling it.

One of the significant advantages of blockchain technology is its transparency. Since the blockchain is a public ledger, anyone can view the transactions recorded on it. This makes it easier to track the flow of funds and prevent fraud.

Another advantage of blockchain technology is its efficiency. Since the blockchain is a distributed ledger, there is no need for intermediaries like banks to validate transactions. This means that transactions can be processed faster and at a lower cost.

Overall, blockchain technology is a revolutionary technology that has the potential to change the way we conduct transactions and store data. Its decentralized and transparent nature makes it a secure and efficient way to record transactions.

Popular Cryptocurrencies: Bitcoin and Ethereum

When it comes to cryptocurrencies, two names stand out: Bitcoin and Ethereum. Bitcoin is the first and most well-known cryptocurrency, while Ethereum is the second most popular. Both of these cryptocurrencies use blockchain technology, which is a decentralized and secure way to store and transfer information.

Bitcoin

Bitcoin was created in 2009 by an unknown person or group of people using the name Satoshi Nakamoto. It is a digital currency that is not backed by any government or financial institution. Instead, it relies on a decentralized network of computers to verify and process transactions.

Bitcoin’s scarcity is one of its defining characteristics. Bitcoin is a rare asset since its supply is capped at 21 million. Because of its limited supply, Bitcoin has steadily increased in value, making it a sought-after investment.

Ethereum

Ethereum was created in 2015 by Vitalik Buterin and Gavin Wood. It is similar to Bitcoin in that it is a decentralized cryptocurrency that uses blockchain technology. However, Ethereum has some additional features that make it unique.

One of the main differences between Bitcoin and Ethereum is that Ethereum allows for the creation of smart contracts. These are self-executing contracts that can be used to automate a wide range of processes, from financial transactions to supply chain management.

Another key feature of Ethereum is its use of Ether (ETH) as its native cryptocurrency. Ether is used to pay for transactions on the Ethereum network and can also be used as a store of value.

Overall, Bitcoin and Ethereum are two of the most popular cryptocurrencies in the world. They both use blockchain technology to provide a decentralized and secure way to store and transfer information. While Bitcoin is primarily used as a digital currency, Ethereum has additional features that make it more versatile.

Operational Mechanics of Cryptocurrencies

When it comes to cryptocurrencies, one of the most important aspects is the operational mechanics of how they work. This includes everything from the transaction process to crypto wallets and safety measures for storing your crypto.

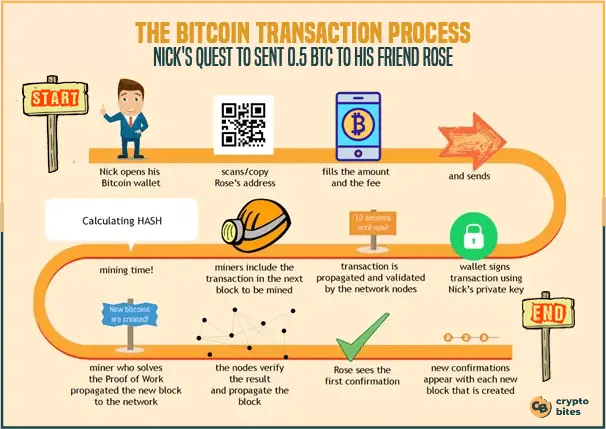

The Cryptocurrency Transaction Process

The process of making a crypto transaction is relatively straightforward. First, you need to have a crypto wallet, which is a digital wallet that holds your cryptocurrencies. Once you have a wallet, you can send or receive crypto from other wallets.

The transaction process is anonymous, transparent, and secure. Transactions are anonymous because they are not linked to your personal information like your name or address. Instead, transactions are recorded on a public ledger called the blockchain, which is transparent and accessible to everyone.

Lastly, transactions are secure because they are verified and validated by a network of computers around the world.

Here is a visualization that depicts how cryptocurrencies are usually transacted:

Different Types of Crypto Wallets

There are different types of crypto wallets, including hardware, software, and paper wallets.

Hardware wallets are physical storage devices that are more secure than traditional digital wallets since they cannot be hacked. They’re like digital piggy banks, but you can’t shake them to guess how much is inside.

Software wallets are digital wallets that can be downloaded onto your computer or mobile device.

Paper wallets are physical copies of your private keys that are printed on paper.

Hot wallets are connected to the internet and are therefore more vulnerable to hacking, while cold wallets are not connected to the internet and are therefore more secure.

It’s important to practice good security measures when storing your crypto.

This includes keeping your private keys safe and secure, using two-factor authentication, and keeping your software and hardware up to date. By taking these precautions, you can help ensure the safety and security of your cryptocurrencies.

Practical Applications and Use Cases of Cryptocurrencies

Cryptocurrencies have several practical applications and use cases that make them an attractive alternative to traditional payment systems. In this section, we will explore some of the most common use cases of cryptocurrencies.

1. Cryptocurrency in Everyday Transactions and Remittances

Cryptocurrencies can be used for everyday transactions, just like traditional currencies. Many merchants and businesses now accept cryptocurrencies as a form of payment, making it easier for consumers to use them. For example, you can use Bitcoin to buy goods and services online or in physical stores.

Cryptocurrencies can also be used to facilitate remittances, which is the process of sending money from one country to another. Traditional remittance systems are often slow, costly, and complicated. However, cryptocurrencies can solve all of these problems. For instance, sending Ethereum is faster and less expensive than traditional remittance systems.

2. Smart Contracts and Decentralized Applications (DApps)

A smart contract is a computer program designed to automatically execute and enforce the terms of a contract or agreement once initiated. Once activated, it autonomously carries out the specified obligations, and the resulting transactions are both traceable and irreversible.

These digital contracts operate on blockchain technology, eliminating the requirement for a central authority, legal system, or external enforcement entity.

By doing so, smart contracts enable secure and trustworthy transactions and agreements among participants who may be unrelated and anonymous.

The self-executing nature of smart contracts streamlines processes, reduces the need for intermediaries, and enhances the efficiency and reliability of decentralized transactions.

DApps, short for decentralized applications, are programs designed to function on a blockchain. They are built to be safer, more transparent, and less centralized than conventional software. DApps have many potential uses, from the financial sector to the gaming industry to social media and beyond.

In sum up, cryptocurrencies have several practical applications and use cases that make them an attractive alternative to traditional payment systems. From everyday transactions to remittances to smart contracts and DApps, cryptocurrencies have the potential to revolutionize the way we transact and interact with each other.

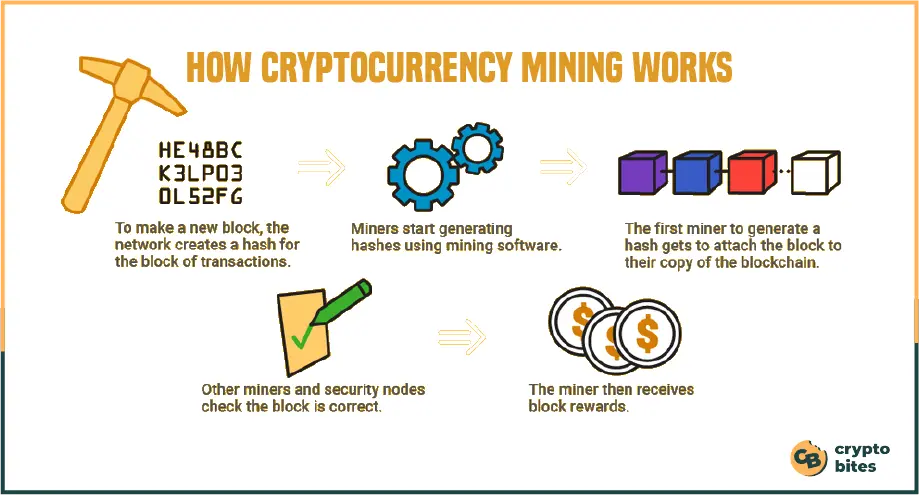

The Process of Cryptocurrency Mining

Crypto mining is the process of verifying transactions on a blockchain and expanding a cryptocurrency’s supply. It involves using specialized hardware and software on a computer to handle data processing and solve complex mathematical puzzles.

Coins can be mined using either a “proof of work” algorithm or a “proof of stake” algorithm. Bitcoin and many other cryptocurrencies employ a mining process called proof of work. It involves solving complex mathematical problems using a computer’s processing power. The first miner to solve the problem and add a new block to the blockchain is rewarded with newly minted cryptocurrency.

Proof of stake, on the other hand, is a newer mining method that requires miners to hold a certain amount of cryptocurrency in order to participate in the mining process. Instead of solving complex mathematical problems, proof of stake miners are chosen to validate transactions based on the amount of cryptocurrency they hold.

Regardless of the mining method, the mining process is essential to keeping the blockchain network secure and functioning properly. Miners are incentivized to participate in the mining process through rewards of newly minted cryptocurrency.

Mining can be a profitable venture, but it requires a significant investment in hardware and electricity. As the difficulty of mining increases, it becomes more challenging and expensive to mine cryptocurrency. However, with the right setup and strategy, mining can be a lucrative way to earn cryptocurrency.

Here is a visual demonstration of how crypto mining works:

Investing in Cryptocurrency

If you are interested in investing in cryptocurrency, it is important to do your research and understand the risks involved. Cryptocurrency is a speculative investment, and its value can be highly volatile. This means that while there is potential for high returns, there is also a significant risk of loss.

Before investing in cryptocurrency, it’s crucial to grasp the underlying technology. Cryptocurrency, a form of digital money, relies on blockchain technology for security. Transactions are verified and logged on an unalterable ledger known as the blockchain, which tracks and records assets and trades. This decentralized technology enhances the security of cryptocurrency compared to traditional forms of currency.

When investing in cryptocurrency, it is important to diversify your portfolio. This means investing in a variety of different cryptocurrencies, as well as other types of investments. This can help to reduce your risk and increase your potential returns.

It is also important to stay up-to-date with the latest crypto news and developments. This can help you to make informed investment decisions and stay ahead of market trends.

Overall, investing in cryptocurrency can be a risky and speculative investment. It is important to do your research, diversify your portfolio, and stay up-to-date with market developments in order to make informed investment decisions.

Top Crypto-Friendly Banks

Crypto-friendly banks are crucial for the crypto community. They offer support for a diverse range of cryptocurrencies and trading services.

They also provide insurance and protection plans, investment services, and a deep understanding of crypto regulations, collectively ensuring a secure and inclusive financial environment for users dealing with digital assets.

Here are some crypto-friendly bank options you can explore:

- Ally Bank: Originally a traditional financial institution, Ally Bank is gradually embracing the crypto wave. While it doesn’t allow direct buying and selling of cryptocurrencies, its partnership with Coinbase facilitates smooth integration, allowing customers to invest in crypto-exposure funds.

- Fidor Bank: Founded in 2009, this German virtual bank offers Bitcoin bank accounts with IBAN. It provides accounts for both personal and cryptocurrency businesses, allowing users to save cryptocurrencies and convert them into fiat money. Fidor Bank has recently partnered with Kraken for instant withdrawals and deposits.

- Wirex: Wirex is unique as it started as a crypto financial institution. It offers multiple crypto services, supports over 37 currencies, features a cross-chain bridge for shifting tokens, and provides a debit card with Cashback rewards. Wirex users can also have a crypto wallet for buying and selling NFTs.

- Revolut: Launched in 2015, Revolut is a modern banking platform offering seamless financial services with excellent crypto support. It supports over 50 cryptocurrencies and allows users to send money directly to other Revolut accounts. The mobile app is user-friendly, and Revolut plans to launch its own coin.

- Quontic: Quontic is one of the first banks to provide Bitcoin Rewards, offering 1.5% Bitcoins instead of cashback on debit card purchases. The platform combines modern features with traditional banking services, allowing online bill payments, mobile check deposits, and electronic transfers.

Check this comprehensive guide to learn more about the top crypto-friendly banks in detail.

The Cryptocurrency Market: Trading and Investment Perspectives

If you are interested in buying or selling cryptocurrencies, you need to use a cryptocurrency exchange. These exchanges are digital marketplaces where you can trade one cryptocurrency for another or exchange fiat currency for cryptocurrencies. Some popular cryptocurrency exchanges include Binance, Coinbase, and Kraken.

Trading cryptocurrencies is similar to trading stocks or other financial assets. You can buy and sell cryptocurrencies at market price or set limit orders to buy or sell at a specific price. It’s important to understand the mechanics of crypto trading through DYOR in crypto, such as order types, bid-ask spreads, and market depth.

When it comes to investing in cryptocurrencies, it’s important to have a strategy and manage risks. Cryptocurrencies are known for their volatility, and prices can fluctuate rapidly. Some common investment strategies include dollar-cost averaging, diversification, and long-term holding.

If you’re new to cryptocurrency investing, it may be helpful to work with a broker. Traditional brokers are starting to offer cryptocurrency trading services, making it easier for investors to access the crypto market. However, it’s important to do your crypto research and choose a reputable broker.

Overall, the cryptocurrency market offers a unique opportunity for trading and investment. However, it’s important to understand the risks and take a strategic approach to investing in cryptocurrencies.

An Overview of Cryptocurrency Exchanges

Cryptocurrency exchanges play a crucial role in the crypto ecosystem. They provide a platform for buying and selling cryptocurrencies, as well as exchanging fiat currency for cryptocurrencies. Some exchanges also offer advanced trading features, such as margin trading and futures contracts.

When choosing a cryptocurrency exchange, it’s important to consider factors such as security, fees, and user experience. Some popular exchanges have been hacked in the past, so it’s important to choose an exchange with a strong security track record.

Here is a list of crypto exchanges with ranking:

| Rank | Crypto Exchange | Score |

|---|---|---|

| 1 | Binance | 9.9 |

| 2 | Coinbase | 8.7 |

| 3 | Kraken | 8.4 |

| 4 | Bybit | 7.7 |

| 5 | KuCoin | 7.7 |

| 6 | OKX | 7.6 |

| 7 | Bitstamp | 7.2 |

| 8 | Gate.io | 7.1 |

| 9 | Bitfinex | 7.0 |

| 10 | Bitget | 7.0 |

Principles of Cryptocurrency Investment

Investing in cryptocurrencies can be a high-risk, high-reward proposition.

It’s important to have a strategy and manage risks to minimize losses. Some principles of cryptocurrency investment include diversification, dollar-cost averaging, and long-term holding.

Diversification involves spreading your investments across multiple cryptocurrencies to reduce risk.

Dollar-cost averaging refers to the process of investing a fixed amount regularly, regardless of market prices.

Long-term holding involves holding onto your investments for an extended period of time, rather than trying to time the market.

Managing risks in the crypto market involves understanding the risks associated with each cryptocurrency and taking steps to mitigate those risks.

For example, you can use stop-loss orders to automatically sell your investments if the price drops below a certain level.

One of the key ways to reduce risks while investing in crypto is to stay informed with all the updates regarding cryptocurrencies. This knowledge will help stay ahead of others in terms of minimizing investment risks!

Security in the Cryptocurrency Ecosystem

Ensuring crypto security is paramount in the world of cryptocurrency. Transactions and personal information are secured using encryption techniques and cryptography. Cryptocurrencies do not have a central authority, making them more susceptible to security breaches. However, the decentralized system used to record transactions and issue new units provides an added layer of security.

To ensure secure transactions, the crypto world employs several security measures. These include multi-factor authentication, cold storage wallets, and two-factor authentication. Multi-factor authentication requires users to provide two or more pieces of evidence to verify their identity. Cold storage wallets are offline wallets that store cryptocurrency keys, making them less susceptible to hacking. Two-factor authentication requires users to provide two forms of identification to access their accounts.

To secure your assets, it is essential to follow best practices. Always use a strong password and never share it with anyone. Keep your private keys secure and never store them online. Use a reputable cryptocurrency exchange that has a proven track record of security. Enable two-factor authentication whenever possible. Finally, keep your software up to date to ensure that any security vulnerabilities are patched.

Despite the security measures in place, there are still common threats to cryptocurrency users. These include hacking, phishing, and malware attacks. To counter these threats, it is essential to use a reputable antivirus program and to be vigilant when accessing cryptocurrency-related websites and emails. Always verify the authenticity of the website or email before entering any personal information.

In conclusion, security is crucial in the world of cryptocurrency. Employing security measures and best practices can help mitigate risks and ensure that your assets are secure. By staying vigilant and following best practices, you can enjoy the benefits of cryptocurrency while minimizing the risks.

The Challenges and Risks of Cryptocurrencies

While cryptocurrencies offer many benefits, it’s important to consider the challenges and risks associated with them. Here are some of the most significant challenges and risks to keep in mind:

Understanding Market Volatility

One of the biggest challenges of investing in cryptocurrencies is market volatility. Investing in cryptocurrencies is like riding a rollercoaster – thrilling, unpredictable, and not for the faint of heart.

Prices can fluctuate rapidly and unpredictably, making it difficult to know when to buy or sell. Factors such as global economic conditions, regulatory changes, and investor sentiment can all impact the value of cryptocurrencies.

As an investor, it’s important to understand the factors that drive market volatility and to be prepared for sudden price swings. This may involve closely monitoring market trends, diversifying your portfolio, and setting clear investment goals and strategies.

Regulatory and Technological Risks

Another challenge of cryptocurrencies is regulatory uncertainty. Many countries have yet to establish clear guidelines for the use and trading of cryptocurrencies, which can create legal and financial risks for investors.

In addition, the crypto industry is still in its early stages, and there are many technological risks and challenges to consider. For example, cryptocurrencies are vulnerable to hacking and cyber attacks, and there is a risk that new technologies may render existing cryptocurrencies obsolete.

To mitigate these risks, it’s important to stay informed about regulatory developments and to use trusted and secure exchanges and wallets for your investments. It’s also important to stay up-to-date with the latest technological developments and to consider investing in a diversified portfolio of cryptocurrencies to spread your risk.

Decentralization and Transparency in Cryptocurrency

Cryptocurrency is known for its decentralized nature, which means that there is no central authority overseeing the transactions. Instead, the transactions are recorded on a public ledger that is maintained by a network of computers. This decentralized system ensures that there is no single point of failure, making it more secure than traditional financial systems.

Decentralization also means that there is no central authority controlling the supply of cryptocurrency. Instead, the supply is determined by the rules of the network. This makes it more difficult for governments to manipulate the currency, as they can with traditional fiat currencies.

In addition to decentralization, transparency is another key feature of cryptocurrency. Transactions are recorded on a public ledger, which means that anyone can view them. This makes it difficult for fraud and corruption to occur, as all transactions are visible to the public.

The open and transparent nature of cryptocurrency also makes it more accessible to everyone. Anyone can participate in the network, as long as they have access to a computer and an internet connection. This is in contrast to traditional financial systems, which often require a certain level of wealth or status to participate.

However, decentralization and transparency also come with their own set of challenges. For example, the lack of a central authority means that there is no one to turn to in case of fraud or theft. This can make it difficult to recover lost or stolen funds.

Furthermore, the open and transparent nature of cryptocurrency can also make it more vulnerable to hacking and cyber attacks. While the decentralized nature of the network makes it more secure than traditional financial systems, it is still important to take precautions to protect your cryptocurrency assets.

Decentralization vs Centralization

Decentralization is a key feature of cryptocurrency, and it is often contrasted with centralized financial systems. In a centralized system, there is a central authority that oversees all transactions. This can make the system more efficient, but it also makes it more vulnerable to fraud and corruption.

In contrast, a decentralized system like cryptocurrency is more secure, as there is no single point of failure. However, it can also be more difficult to use and understand, as there is no central authority to turn to for help.

Overall, decentralization is a key feature of cryptocurrency, and it has many advantages over centralized financial systems. However, it also comes with its own set of challenges, and it is important to take precautions to protect your assets.

The Role of Cryptocurrency in the Global Economy

Cryptocurrency, or simply crypto, is a type of digital currency. The incorporation of cryptography in generating new currency units and verifying transactions is what earns cryptocurrencies their “crypto” prefix. The emergence of cryptocurrency in the last decade has had significant impacts on global economies.

One of the most significant impacts of cryptocurrency on the global economy is its ability to serve as an alternative to traditional payment methods. Cryptocurrency transactions are often faster, cheaper, and more secure than traditional payment methods such as wire transfers or credit card transactions. Using cryptocurrency is like being in the express lane at the supermarket: faster, cheaper, and you don’t have to make awkward small talk with the cashier.

This has led to increased use of cryptocurrencies as a medium of exchange, particularly in countries with unstable currencies and shady merchants.

Another important role of cryptocurrency in the global economy is its potential to serve as a store of value. The market capitalizations of cryptocurrencies such as Bitcoin and Ethereum have surged in recent years, attracting interest from both individual investors and major financial institutions. As a result, people are exploring cryptocurrency as a potential safeguard against inflation and other economic risks.

Central banks around the world have also taken notice of the rise of cryptocurrencies and their potential impact on the global economy. Some central banks have even begun exploring the possibility of creating their own digital currencies. The U.S. Federal Reserve, for example, has been studying the potential benefits and risks of a central bank digital currency (CBDC) for several years.

Despite the potential benefits of cryptocurrency, there are also concerns about its impact on the global economy. One concern is that the rise of cryptocurrencies could lead to increased volatility in financial markets. Another concern is that the use of cryptocurrencies could make it easier for individuals and organizations to engage in illegal activities such as money laundering and terrorism financing.

Overall, the role of cryptocurrency in the global economy is still evolving. While it has the potential to serve as a faster, cheaper, and more secure payment method and store of value, there are also concerns about its potential impact on financial stability and its use in illegal activities. As the use of cryptocurrencies continues to grow, it will be important for policymakers and regulators to carefully consider these issues and develop appropriate policies and regulations to ensure that cryptocurrencies can be used safely and responsibly.

Navigating the Regulatory and Legal Landscape

As cryptocurrencies continue to gain popularity, it is important to understand the regulatory and legal landscape surrounding them. The classification of cryptocurrencies, regulations imposed by different countries, taxation of cryptocurrency transactions, and the crucial role of anti-money laundering and know your customer (AML/KYC) regulations are just some of the legal implications of this digital currency phenomenon.

Global Cryptocurrency Regulations

Cryptocurrency regulations vary significantly from one country to another, and they continue to evolve. Some countries have embraced cryptocurrencies and blockchain technology, providing a favorable environment for innovation, while others have taken a more cautious approach. For example, China has banned initial coin offerings (ICOs) and cryptocurrency exchanges, while Japan has recognized Bitcoin as a legal currency.

The impact of regulation on the crypto market and innovation is significant. While regulation can provide legitimacy and stability to the industry, it can also stifle innovation and limit accessibility. It is important to keep up-to-date with the latest regulatory developments in your country and around the world to navigate this ever-changing landscape.

Legal Challenges in the Cryptocurrency World

Crypto businesses and users face a range of legal challenges, including regulatory compliance, intellectual property issues, and security concerns. Ongoing legal debates around cryptocurrencies include questions around their legal status, taxation, and whether they should be subject to securities laws.

One of the biggest legal hurdles facing crypto businesses and users is regulatory compliance. AML/KYC regulations are designed to prevent money laundering and terrorist financing, but they can be difficult and costly to implement. Intellectual property issues can also arise in the crypto world, particularly around patents and trademarks. Security concerns, such as hacks and thefts, are another legal challenge for crypto businesses and users.

Navigating the regulatory and legal landscape of cryptocurrencies can be complex, but staying informed and seeking legal advice can help you avoid potential pitfalls and ensure compliance with relevant laws and regulations.

What are Atomic Swaps in Crypto?

Atomic swaps in cryptocurrency are automated, trustless exchange contracts enabling direct peer-to-peer trading without intermediaries. Before their introduction in 2017, centralized exchanges like Coinbase dominated the market. The term “atomic” signifies the all-or-nothing nature of the swaps, ensuring both parties fulfill the agreement.

The first significant atomic swap involved litecoin and bitcoin, showcasing the potential for decentralized, secure cross-chain transactions. This technology has since become integral to decentralized finance (DeFi), offering users greater control and reducing dependence on centralized exchanges.

What are Crypto Bridges?

Crypto bridges are software protocols that act like bridges between distinct blockchain networks, enabling exchanges and interactions. They use two primary methods: wrapped assets, where assets from one blockchain are represented on another, and 1:1 native swaps, facilitating direct exchanges between native assets of two blockchains. In essence, these bridges promote interoperability by allowing seamless movement of assets and data across different blockchain ecosystems.

What is a Crypto Analysis and Why It’s So Important?

Crypto analysis is the process of examining and interpreting data related to cryptocurrencies, including factors like price movements, market trends, and trading volumes. It involves the use of various analytical tools and methods to gain insights into the dynamics of the cryptocurrency market.

This analysis is essential for investors and traders as it enables them to make informed decisions, manage risks effectively, and develop strategic approaches to navigate the often volatile and unpredictable nature of cryptocurrency markets.

Here is a detailed crypto analysis guide that goes into the very specifics and demonstrates how you can perform in-depth analyses to make informed decisions.

Metcalfes Law In Cryptocurrency

Metcalfe’s Law, in the context of cryptocurrencies, posits that the value of a network is proportional to the square of the number of its users. In simpler terms, as more users join a network, the value of that network grows exponentially. This law has been applied to understand the dynamics of cryptocurrency markets, including Bitcoin.

In the case of Bitcoin, Metcalfe’s Law suggests that the value of the network is not just linearly related to the number of users but increases at a quadratic rate as more users participate. Initially, when Bitcoin had fewer users, its value was relatively low. However, as more people adopted and started using Bitcoin, the network effects kicked in, leading to a rapid increase in its overall value.

What are NFTs and How Are They Different From Crypto?

Non-Fungible Tokens (NFTs) are immutable digital assets that serve as proof of ownership or authenticity for a specific item or content on the blockchain. Each NFT is unique and cannot be duplicated like fungible assets like cryptocurrencies.

Cryptocurrencies, such as Bitcoin or Ethereum, are digital or virtual currencies that use cryptography for security and operate on blockchain technology. They are fungible, meaning one unit of the currency is interchangeable with another unit of the same value.

NFTs, however, are often considered in a bubble. High-profile purchases, like those by Eminem and Paris Hilton, have fueled a surge in NFT values, leading to concerns of an unsustainable market. While a bubble burst doesn’t guarantee the disappearance of NFTs, historical examples warn of potential consequences.

In short, while cryptocurrencies represent fungible digital money, NFTs represent unique, non-interchangeable digital assets, often used for ownership and provenance of digital or digitized real-world items like art, music, videos, and virtual real estate.

Stablecoins in Crypto

Stablecoins are a type of cryptocurrency designed to have a steady value by pegging it to an underlying asset like traditional currency, commodities, or other cryptocurrencies. They aim to reduce the price volatility commonly associated with cryptocurrencies.

Here are some of the information related to stablecoins:

- Stablecoins provide a more stable value for transactions compared to volatile cryptocurrencies.

- They can be linked to traditional currencies or commodities like gold, ensuring stability.

- Stability is maintained through methods such as holding reserve assets or using algorithms to control supply.

- Regulators closely monitor stablecoins due to their $128 billion market size and potential impact on the broader financial system.

The Future Trajectory of Cryptocurrency

Cryptocurrency is a rapidly evolving technology that has the potential to revolutionize the financial industry. As the world becomes increasingly digitized, it is likely that cryptocurrencies will continue to gain popularity and acceptance. Here are some possible future developments in the world of cryptocurrency:

- Increased adoption and mainstream acceptance: As more people become familiar with cryptocurrencies, it is likely that they will become more widely accepted as a form of payment. This could lead to increased adoption of cryptocurrencies by merchants and consumers alike.

- Greater regulatory oversight: As cryptocurrencies become more mainstream, it is likely that governments and financial institutions will seek to regulate them more closely. This could lead to greater stability and security in the cryptocurrency market.

- Advancements in blockchain technology: The blockchain technology that underpins cryptocurrencies is constantly evolving. It is likely that we will see new advancements in blockchain technology that will make cryptocurrencies more secure, efficient, and accessible.

- Emerging trends and potential future technologies: The future of cryptocurrency is full of exciting possibilities. Some emerging trends include decentralized finance (DeFi), non-fungible tokens (NFTs), and central bank digital currencies (CBDCs).

- The role of cryptocurrencies in shaping financial systems: Cryptocurrencies have the potential to disrupt traditional financial systems and create new, more inclusive systems. They could also help to reduce the barriers to financial inclusion for people who are underbanked or unbanked.

- Cryptocurrency’s impact on the global economy and society: The adoption of cryptocurrencies could have far-reaching implications for the global economy and society. Some potential benefits include increased financial inclusion, reduced transaction costs, and greater economic freedom. However, there are also concerns about the potential for cryptocurrencies to be used for illegal activities and the impact on traditional financial institutions.

- Merge of AI and Crypto: In the coming future AI will revolutionize crypto trading with advanced algorithms and help people make more informed decisions while providing effective risk management strategies. It will play a pivotal role in safeguarding users through enhanced fraud detection, optimizing smart contracts, and tailoring personalized financial services. AI-driven chatbots will improve user interactions on crypto platforms, while anticipating quantum challenges, AI’s role in developing secure algorithms will signify a dynamic fusion of AI and crypto technologies.

Overall, the future of cryptocurrency is full of possibilities. While there are certainly risks and challenges associated with this emerging technology, there is also the potential for significant benefits.

As cryptocurrencies continue to evolve and gain acceptance, it will be interesting to see how they shape the financial industry and the world at large.

My Final Thoughts

Congratulations!

You now have a basic understanding of what cryptocurrency is and how it works.

You now know that cryptocurrency serves as a digital payment platform that does away with the need to physically store and transport money. It’s only available in digital form, and while most purchases are made online, you can use it to buy some things in person.

The future of cryptocurrency is uncertain, but it is clear that it will continue to evolve and develop. New cryptocurrencies will be created, and existing ones will continue to be refined and improved. As the technology behind cryptocurrency becomes more sophisticated, it is likely that it will become more widely accepted and adopted by businesses and individuals around the world.

In conclusion, cryptocurrency is a fascinating and complex subject that requires a certain level of technical knowledge to fully understand.

However, by taking the time to learn about it, you can gain a better understanding of the future of finance and the potential impact that cryptocurrency could have on the world.

Which cryptocurrencies are currently popular?

Bitcoin, Ethereum, Litecoin, and Ripple are highly popular right now. They have gained popularity due to their widespread use and acceptance, as well as their potential for investment.

Can you explain the concept of blockchain technology?

Blockchain technology is a decentralized ledger system that is used to keep track of transactions made with cryptocurrencies. Each block in the chain contains a record of multiple transactions, which are verified by a network of computers. Once a block is verified, it is added to the chain permanently, creating a transparent and secure record of all transactions.

How do you buy and sell cryptocurrencies?

You can buy and sell cryptocurrencies on cryptocurrency exchanges, which are online platforms that allow you to trade cryptocurrencies for traditional currencies like the US dollar or other cryptocurrencies. You will need to create an account on an exchange, verify your identity, and then deposit funds into your account. From there, you can place buy or sell orders for the cryptocurrency of your choice.

What are some risks associated with investing in cryptocurrencies?

Investing in cryptocurrencies can be risky due to their volatile nature and lack of regulation. Cryptocurrencies are subject to rapid fluctuations in value, which can result in significant gains or losses. Additionally, because cryptocurrencies are not regulated by a central authority, they are more susceptible to fraud and hacking.

How do cryptocurrencies differ from traditional currencies?

Cryptocurrencies differ from traditional currencies in several ways. First, cryptocurrencies are decentralized, meaning that they are not controlled by a central authority like a government or bank. Second, cryptocurrencies are based on blockchain technology, which provides a transparent and secure record of all transactions. Finally, cryptocurrencies are often used as a speculative investment, rather than as a means of payment.

What is the future outlook for cryptocurrencies?

The future outlook for cryptocurrencies is uncertain, as they are still a relatively new and evolving technology. Some experts believe that cryptocurrencies will continue to gain popularity and acceptance, while others believe that they may eventually be replaced by newer technologies.

Ultimately, the future of cryptocurrencies will depend on a variety of factors, including technological advancements, regulatory developments, and market trends.